Introduction

The basic formula for building wealth is simple: Income - Expenses = Money available for investing.

While increasing income is important, cutting fixed costs has the advantage of being a one-time effort with lasting results. Over six months, I reviewed all my fixed costs and successfully reduced them by about $500 per month.

In this article, I’ll share exactly what I changed and how.

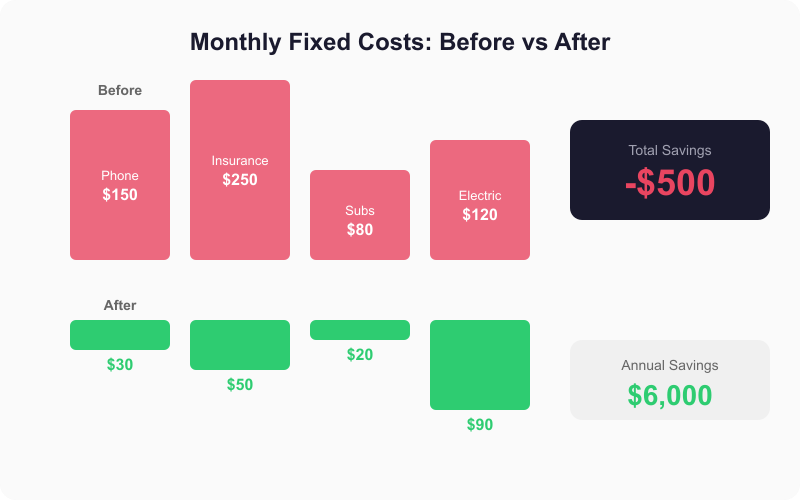

Before and After Comparison

Let’s start with the big picture.

My monthly fixed costs dropped from $1,500 to $1,000. That’s $500/month or $6,000/year in savings.

1. Switched to a Budget Phone Plan (-$120/month)

This had the biggest impact.

Before: Two phones on a major carrier → $150/month After: Switched to a budget carrier (20GB plan) → $30/month

Key takeaways

- I used carrier support maybe once a year — online support is enough

- Never hit the data cap on the 20GB plan

- Switching took about 30 minutes per phone

I was worried about losing my carrier email, but I realized I only use messaging apps and Gmail anyway.

2. Reviewed Insurance (-$200/month)

Many people are over-insured, and I was no exception.

Before: Health + cancer + pension insurance → $250/month After: Basic health insurance only → $50/month

How I thought about it

- National health insurance already caps out-of-pocket medical costs

- Private pension insurance has low returns — index investing is more rational

- Cancer insurance isn’t needed if your savings can cover the cost

Of course, the right answer depends on your family situation and risk tolerance. This was just my personal decision.

3. Subscription Audit (-$60/month)

“It’s only a few dollars a month” adds up fast if you’re not paying attention.

What I cancelled:

- Streaming services (consolidated from 2 to 1): -$15

- Unused cloud storage: -$13

- Gym membership (wasn’t going): -$32

How to do it

- Review 3 months of credit card statements

- List every recurring monthly and annual charge

- Ask: “Did I use this last month?“

4. Switched Electricity Provider (-$30/month)

In deregulated electricity markets, you can choose your provider. Just compare rates.

Before: Regional power company → $120/month After: New provider (no base fee plan) → $90/month

The switch took about 15 minutes online. No installation required.

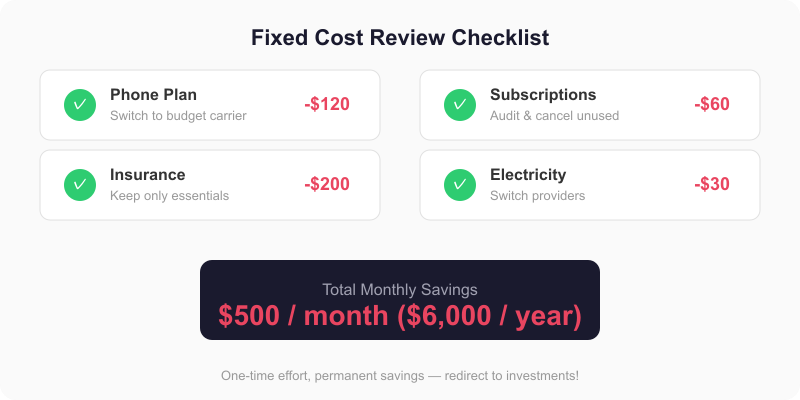

Savings Summary

| Category | Before | After | Savings |

|---|---|---|---|

| Phone | $150 | $30 | -$120 |

| Insurance | $250 | $50 | -$200 |

| Subscriptions | $80 | $20 | -$60 |

| Electricity | $120 | $90 | -$30 |

| Other | $100 | $60 | -$40 |

| Rent | $800 | $650 | -$150 |

| Total | $1,500 | $900 | -$600 |

*Rent was reduced by moving (trade-off with commute time)

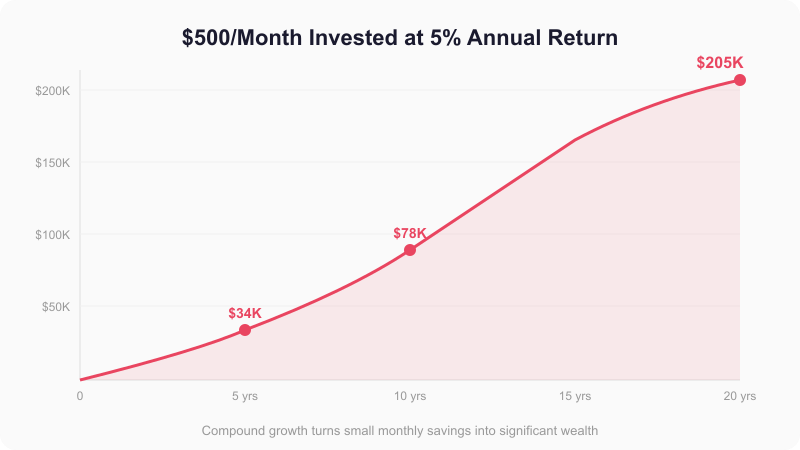

What Happens When You Invest the $500 Savings

This is the most important point.

If you invest $500/month at a 5% annual return:

- After 5 years: ~$34,000

- After 10 years: ~$78,000

- After 20 years: ~$205,000

Just by reviewing your fixed costs, you could build over $200,000 in 20 years.

Conclusion

Cutting fixed costs is the most powerful savings method because once you do it, the savings happen automatically every month.

- Phone bill → Switch to a budget carrier to save $1,400/year

- Insurance → Keep only what you truly need

- Subscriptions → Audit your card statements and cancel the unused ones

- Electricity → Switch to a cheaper provider

The key is not to let the savings disappear into random spending. Set up automatic transfers so the freed-up money goes straight into investments.

I personally have automatic index fund purchases set up on payday. Once it’s configured, there’s nothing else to do.